Insights

Welcome to the P&P newsroom.

Check out exclusive news, views and business updates for the Properties & Pathways team.

Filter by:

The Best Property Data Software to Help Find Your Next Investment

It’s 2025. Investors on the hunt for their next acquisition spend most of their time in front of screens, and…

Owning a Million-Dollar Home in Australia is Now Just “Average”

The Australian Bureau of Statistics (ABS) announced on June 10 that Australia quietly hit a huge milestone in the March…

Why Australia’s AAA Credit Rating Matters for Property Investors

When news broke that the United States had lost its AAA credit rating, every investment publication turned its head… for…

The US Just Lost Its AAA Credit Rating—Here’s What That Actually Means

On May 16, 2025, Moody’s Investors Service downgraded the United States’ national credit rating from AAA to AA+, marking the…

Why WALE Matters When Selling Your Commercial Asset

When preparing a commercial property for sale, it’s easy to focus on its physical features—location, floor space, amenities or even…

5 reasons a positively geared property could suit you

A positively geared property might sound too good to be true for some, when rental income exceeds your investment property’s…

Where are super funds investing in 2025?

Last month, Aware Super made a $1.6-billion investment in a singular industrial property transaction in Melbourne’s North precinct. It’s a…

How to conduct the most thorough pre-purchase inspections

If you’re serious about property investment, whether commercial or residential, you already know that due diligence is everything. That means…

What the 2025 federal election might do for real estate

It’s almost that time again, when our political parties battle it out for the public’s attention. The Australian federal election…

Why Australian real estate could be the best investment asset on the planet

When it comes to investments, politics and the economy, little ol’ Australia barely gets a mention on the international stage.…

Case study: Turning uncertainty into opportunity through due diligence

Case study: 16 Thomas Road, Kwinana Beach When evaluating an investment property, ensuring a thorough due diligence process is essential…

Do federal elections really impact the property market?

Well, we’re about to gear up for another federal election. With the two-horse race in full swing, the question often…

How technology has changed the real estate industry

Real estate used to be the type of industry that would barely budge its trends and processes. For decades, while…

Properties & Pathways secures prime Shepparton retail asset

We’re excited to share the details of our latest acquisition—a high-exposure retail asset in Shepparton, Victoria—secured under the Pathway 8…

Changing property managers mid lease? The top dos and don’ts

Changing property managers while your commercial tenant is still under lease may seem daunting, but in a lot of cases,…

7 smart ways to invest your inheritance

You’ve received an inheritance and perhaps it’s a sum that has the potential to change your life. This means financial…

Will mining drive Perth’s property boom in 2025?

Perth’s property market has long held hands with Western Australia’s mining sector. It historically has run along a similar trajectory,…

What this month’s RBA rate cut means for us investors

For the first time in over four years, the Reserve Bank of Australia has today cut the cash rate. Following…

High speed trains: The answer to Australia’s housing affordability crisis?

Soaring property prices in major cities, traffic congestion and an increasing number of people relocating to regional areas. Australia’s affordability…

7 ways Trump’s presidency could impact the Australian property market

Donald Trump. Even just saying the name sparks reactions, from enthusiasm to outright disdain. But whether you’re a fan of…

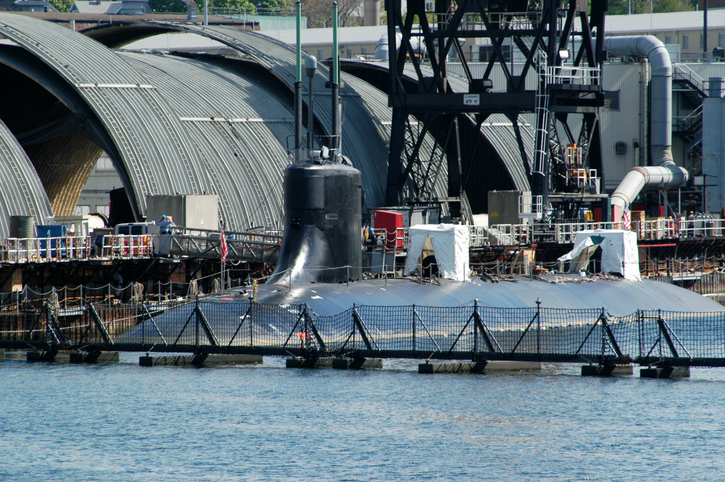

How the AUKUS agreement could impact the property market

AUKUS—is it all about submarines? Well, yes, that of course is the Australian government’s intent with the AUKUS Agreement, a…

How short-term rates and a weaker Aussie Dollar impact the Australian property market

When was the last time you checked in on short-term interest rates? Or considered how the strength of the Australian…

9 ways to make your money work for you

You might’ve heard it before: rich people never became rich by being employees. Because even if they started their journey…

Cal makes the cover of Business News’ magazine

Few bigger business publications exist in WA than Business News. And after our managing director, Cal Doggett, gave senior journalist…

What’s in store for the residential property market in 2025?

Google must be having a helluva time fielding queries about Australia’s residential market in 2025. Existing residential property owners and…

What’s in store for commercial real estate in Australia in 2025?

Like a ship after a passing storm, it appears Australian businesses have finally stopped rocking in the wake of the…

How did Australia’s property market turn out after the last few booms?

If you’ve had skin in the game, the last three years in the country’s property market has been very exciting.…

What to do with an inheritance? Seven ideas that don’t involve spending it.

With a bit of strategy, you can turn your inheritance into a lasting investment that secures your and your family’s…

How America influences Australia’s economy and property market

Which holds more sway over Australia’s economy: our own federal elections here in Australia? Or the US elections? It’s not…

Why net effective rent is the first calculation property investors should make

No matter what type of commercial real estate you’re investing in, knowing the net effective rent can provide a clear…

The benefits of sale and leaseback transactions in Australian property

Sale and leasebacks mightn’t be the most common transactions in the Australian property market. But they do exist and, more…

5 ways buying wisely in the property market can supercharge your retirement

When planning for retirement, most people think of superannuation, savings accounts and investment portfolios. But, in our experience, a powerful…

Is now a good time to invest in Australian property?

We’re already deep into the 2024-25 financial year, and whether at networking events or family barbecues, we’re frequently asked whether…

The case for commercial property developments for Australian investors

Buying established commercial real estate comes with a range of benefits—from the security of existing tenants to the comfort of…

Data shows fast food investment is here to stay

Unprecedented growth. That’s what Australia’s fast food industry is seeing these days, cementing its place as a key destination for…

The best ways to invest $500k in Australia

If you have $500,000 ready to put into an Australian investment… congratulations. These days, it’s no easy feat to lock…

Is it worth buying property with super?

Buying property with super can come with tax effective and asset protective benefits. But the strategy also comes with a…

Brisbane vs Melbourne: Which city offers better property investment opportunities?

Which capital city is best for your property investment capital: Brisbane or Melbourne? In the first of our State vs…

What is an Agreement for Lease? And what should an AFL include?

Fewer parties are more important in a commercial property transaction than your tenant. Which is why ensuring favourable lease terms…

Why fast food is a top menu item for property investors

Fast food is a common feature on many Australian dinner tables. But is take away just as popular with commercial…

Will interest rates drop in 2024? And what will rates be in 2025?

Will interest rates drop in 2024? Where will the cash rate be in 2025? And do we have a crystal…

How inflation can benefit borrowers—not bankers

Headlines of rising inflation are usually met with groans. Because inflation naturally means the value of each dollar in our…

How we reactivated one of Perth CBD’s biggest recent office acquisitions

503 Murray Street in Perth’s CBD is an asset that excited us right back before we acquired it in 2023.…

A property investor’s look at the 2024 financial year

When the RBA began hiking rates back in March 2022, the property market saw a blatant decline in transactions, enquiries…

Post-COVID office trends: East coast stays home, Perth returns to office

Some things change while old habits never die. During the pandemic, the country’s white collar work arrangements saw a rapid…

Understanding lease incentives in Australian commercial real estate

If you’ve imagined yourself as a commercial landlord, understanding commercial lease incentives is a must before buying a commercial asset.…

Recognising the risks of investing in commercial property in Australia

As investors, we’re all about safety and security. But there can be a time to face challenges, to understand them,…

Why Perth’s Office Market is outshining east coast assets

Perth’s office market has become the poster child for resilience and future growth potential since the pandemic, solidifying the west…

Why commercial property is more accessible than you think

When the Australian Financial Review writes a story on a 47-year-old single mother’s journey to a comfortable retirement, all thanks…

Land prices in Perth soar in line with record sales

The noise in Perth’s residential property market continues to grow, as more interstate and international arrivals join the hoards of…

Australia’s rapid population growth and its impact on real estate

You’re not alone if you’re noticing more car and foot traffic on Australia’s city roads and pathways. Experts have revealed…

When to get into real estate: to build new, to buy or to hold land?

Choosing whether to buy land, build new or purchase an existing property is a decision many property buyers consider at…

Residential property vs commercial property investment in 2024

How can two types of real estate be so different? The residential property vs commercial property investment debate is a…

Perth’s CBD Office Market Review: Q1 2024

As West Australia’s economy continues its upward trajectory, the first quarter of 2024 reflected surging demand and resilient rental trends…

What is GAV and NAV? A guide for commercial property investors

You’ve purchased a commercial property, or maybe you’re looking to. The asset is generating solid passive income and its new…

Is commercial real estate a good investment?

Real estate investors have always been among the country’s wealthiest. Just take a look at each year’s AFR Rich List.…

How to calculate rental yield on a rental property

Buying a rental property is an exciting investment. You’re purchasing a bricks and mortar investment—something you can touch and feel.…

“National office market downturn” in 2024—why this is just not true

Headlines are declaring a downturn in the nation’s office market. While this is true of some of Australia’s markets, it’s…

Why Perth’s residential market will lead the nation until at least 2026

Perth’s housing market is leading the nation, and predictions are for this buoyancy to continue—perhaps until at least 2026. Even…

![A shared investment journey [Video]](https://staging.pandp-admin.com/wp-content/uploads/2023/12/pandp-scaled-e1702524416575.jpeg)

A shared investment journey [Video]

Want to get to know us a little better? Our three Properties & Pathways directors—Cal Doggett, Justin Smith and Guy…

Why tax deferred distributions can bolster your property trust investment

For investors wanting strong cash flow, one of the greatest appeals of investing in a property trust is that income…

Child’s Play: Why a childcare property investment can be a smart move

Australian commercial real estate is rebounding from the pandemic, which is why so many are turning towards the asset class…

Top 5 fundamentals of constructing commercial properties in Australia

The outcome? A prosperous, long lasting and highly-relevant premises. The journey? Well, it can be fraught with risks and complexities—for…

Yield vs Property Value: How they’re connected in commercial property

Commercial property investors should understand the relationship between yield and property values. Because knowing how these two components correlate can…

3 words to describe the Perth property market in 2024

One month already down in 2024. And in a year that will likely be as momentous as its predecessor, we…

A guide to property investment funds—and are they good investments?

Jumping into property investing can seem exciting at first, but a couple of hours of exploring the sea of available…

How interest rate cuts in 2024 could do (even more) wonders for unlisted property trusts

The property market has eagerly awaited every Reserve Bank meeting announcement since interest rates began rising in May 2022. But…

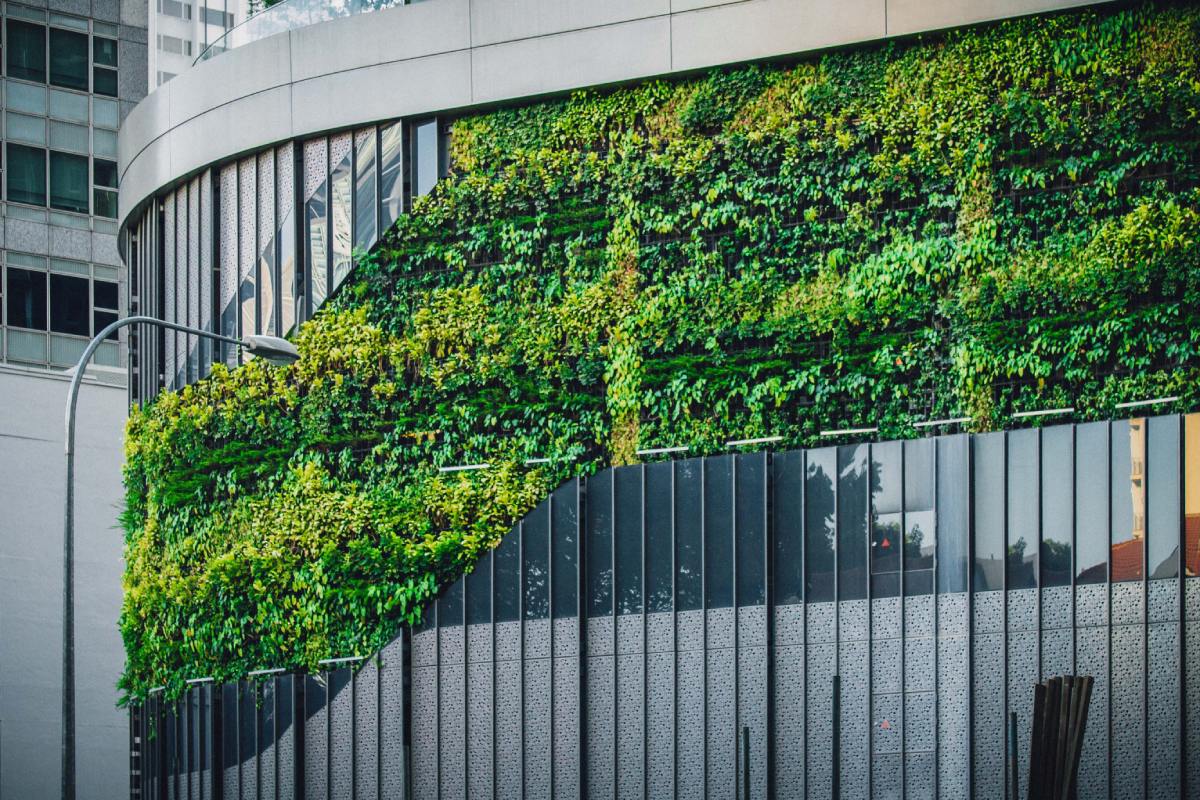

NABERS, green credentials and commercial property investment

While there is an authoritative obligation for commercial real estate to uphold green standards, smart landlords own sustainable properties not…

Investing in commercial real estate during high interest rate environments

Investing wisely during times of high interest rates is a priority for many Australian investors looking to stay on the…

Why Perth’s CBD Office Market is the brightest in Australia

When it comes to office real estate markets in Australia, Perth's CBD is standing out as a top performer nationwide,…

In the rearview mirror: Australia’s industrial property landscape in 2023

2023 revealed an Australian industrial real estate market that – while resilient – bore the marks of evolving dynamics. Unlike…

No stopping Aussie e-commerce growth and industrial warehouse demand

As online shopping continues to surge, CBRE’s latest forecasts predict that around 1.1 million square meters of dedicated e-commerce warehouse…

The 6 fears that keep investors from investing in commercial property

Investments come with risk. And investors come with fears. In commercial real estate investment, the fear to invest can be…

Unlocking success in office real estate investing

In the world of real estate, one thing is crystal clear: no two commercial property investments are ever the same.…

The ultimate 2024 green credentials guide for Australian commercial property landlords

Sustainable investment practices, environmental consciousness and eco-friendly building strategies have taken centre stage in 2024. Today, more than ever, landlords…

How to choose the right syndicate for Australian commercial property investment

Investing in commercial real estate through property syndicates in Australia has gained significant popularity in the last several years. Especially…

Why a Reserve Fund is vital for your commercial property investment

If you’ve ventured into the realm of commercial property investment in Australia, you’re likely no stranger to the term “reserve…

Cal’s appearance on WA’s leading real estate podcast

This week, our managing director Cal Doggett shared the Properties & Pathways story and the organisation’s investment strategies on WA’s…

A snapshot of property markets around the world in 2023

Ever considered what’s happening in Canada’s real estate sector? Do you stop to consider if China has the same trends…

The three types of commercial property investment

Commercial property investment is an attractive asset class that offers a myriad of opportunities for investors with varying risk appetites…

The tax advantages of commercial property investment

Australian real estate has always been an attractive option for investors, both domestic and foreign. And while residential properties grab…

Why invest in commercial property via a syndicated unit trust?

Author’s note: Any information provided in this post has not considered the objectives, financial situation or needs of any investor;…

The ABCs of capital growth property investment in Australia

So, you’ve heard the term ‘capital growth property investment’ and you’re intrigued. It has a bit of a ring to…

Unravelling the promise of Perth’s office rental market in 2023

The headlines may be stirring up concerns about office rents skyrocketing, but that’s not telling us the story about the…

Perth office market shows off its resilience to the rest of the country

Perth’s office market has proven itself to be a vibrant and resilient sector in 2023, defying some of the trends…

Direct Investment vs Unlisted Property Trust

Direct investment in commercial real estate or unlisted property trust? Both options have their advantages and their considerations, and understanding…

The Path to Profit: 5 reasons investors invest in commercial property syndicates

Let’s face it, traditional commercial real estate investment can be a bit like navigating a maze with hidden traps. Any…

Why high inflation can make commercial real estate even more attractive

Commercial real estate investment is known for its high yields, long-term security and stability. But right now, its ability to…

How we’d take advantage of a property market crash in Australia

It’s faux pa to mention property market crashes around potential investors, but the reality is they do happen. Are we…

What to look for when inspecting commercial property

The early introduction to a commercial property investment is usually from high resolution images, catchy headlines, and a seductive smile…

How much do I need to invest in commercial property?

Commercial real estate is known for being the investment of the elite. With price tags for a high-quality commercial asset…

Have interest rates in Australia hit a ceiling in 2023?

It’s the question us investors want an answer to. Because many players in the market don’t deal well with uncertainty.…

The case for healthcare property investment in Australia

Australians need healthcare more than ever. But premises for the industry are in severe shortage. An ageing population, an increase…

Why did three US banks fail? And should Australia be worried?

From commercial real estate investors to stock market players, banks are what keeps our financial system ticking over. So, should…

7 ways to maximise rental income for your commercial property

Last week, we gave you investors some handy hints as to what a commercial property valuer looks for when they…

Want a solid property valuation? Commercial valuers look for these 5 things

Commercial real estate contracts are pages and pages long. But there’s one item on both a sale and loan contract…

How much does it cost to invest in commercial property?

You’ve probably heard commercial real estate is a rewarding investment. Talk of high yields and opportunities for massive capital growth…

5 reasons vacant commercial property could make you more wealthy

We know what you’re thinking: Buying a vacant premises in the commercial property market is surely going to cause all…

Australia’s top 20 super funds recorded negative returns in 2022 (but commercial property didn’t)

The average return of balanced super funds in 2022 was negative 4.8 per cent, and only two super funds made…

How Brisbane’s infrastructure boom will impact real estate values

Queensland’s construction pipeline has exceeded $70 billion as of this writing, already having received a $1.47-billion infrastructure boost from the…

Using a commercial property buyer’s agent: is it worth it?

A commercial property buyer’s agent can help even the busiest investor get into commercial real estate investment. Because after diaper…

What is the relationship between cap rates and interest rates?

The capitalisation rate is a very useful measurement for Australian commercial real estate investors, whether using it to determine the…

WA industrial property market update: January 2023

Not in 15 years have we seen such exciting activity in Perth’s industrial property market. And in 2023, there’ll be…

Rental yield vs capital gain: which will supercharge your wealth?

Rental yield versus capital growth: it’s an age-old argument of cash flow versus capital growth, and a debate that is,…

5 big advantages of diversifying your investment portfolio

Diversification remains one of the biggest focuses for investors these days. One major advantage is of course reduced risk. After…

Case study: Our $78.8m industrial portfolio sale: over 38% uplift in four years

Overview Intense market research and even an R&D-focused trip to the US in 2017 led us to a huge gap…

How landlords can bolster their green credentials in 2023

Relevance. It’s what us commercial property investors think of whenever we look for a new property. And there’s nothing more…

Australian real estate in 2023: What can you expect?

What will Australian real estate in 2023 be like compared to 2022? Depends what you think Australian real estate looked…

Our top commercial property investment fundamentals

The top commercial property fundamentals will almost certainly position you toward success if applied correctly. The Collins Dictionary says that a…

Investing with an income trust? Consider these 4 things first

You’ve decided you want to increase your regular income, perhaps to bolster the retirement that’s around the corner or merely…

Perth CBD Office Property Market Update: November 2022

With mining activity on the move and certainty of the future relevance of office space on the up, Perth’s CBD…

Where should you invest when interest rates are high?

If you sigh every time you hear of another interest hike, you’re not alone. Australians are watching their loan repayments…

Breaking down Labor’s 2022 ‘buy now, pay later’ federal budget

The Albanese government’s first federal budget was handed down by Treasurer Jim Chalmers last week, and in it – aside…

Are we about to see a correction in Perth’s property market?

Panic and confusion. At the tail end of 2022, that’s what some headlines will make you believe is the tone…

How a long-term investment can secure your retirement

For many parents, putting a few bucks aside each week just won’t cut it if they want to spend their…

Property development versus property investment

Do I build or do I buy new? You won’t find a more common and confusing decision in the real…

Brisbane property market update: October 2022

It might seem like you only bought your Secret Santa present a couple months ago, but surprise surprise we’re on…

Should I buy a new or old commercial property?

‘Should I buy commercial property?’ It’s a common question for investors, especially those new to the commercial market. Commercial property…

Why the bank is your best property investment partner

There are also sorts of investment partnerships out there, from angel investors, start-up investors, joint venture arrangements and private lenders.…

Industrial property market update: September 2022

Make no mistake, 2021 was the industrial market’s biggest year in decades and will remain the sector’s monolith era for…

What family offices should look for in commercial real estate

Commercial real estate is a flagship investment for many family offices and their wealth managers. But when teaming up with…

Baby Bunting posts record sales against COVID and logistics headwinds

In an age of retail uncertainty, backed by COVID-related trading restrictions and worldwide supply-chain disruptions, Baby Bunting has posted record…

Where to park your money after a property sale

Your solicitor calls. Your property has sold. She congratulates you and you hug your partner. You pop the cork on…

When will interest rate rises become a problem for borrowers?

As expected, the RBA decided to increase the cash rate by a solid 0.50 basis points last week. The nation’s…

How to find the right real estate syndicator for you

Last week, we talked about the differences between investing in a property syndicate and investing alone. If you’re interested in…

Property syndicates vs Investing alone: The comparison

The real estate market welcomes more and more investors every year. While experienced operators continue buying and first timers start…

What’s ahead for Queensland’s property market

As Australia’s countless number of real estate markets come off the boil, the remaining players in the field are searching…

Here’s why your financial planner doesn’t like real estate

Ever told your financial planner you’re considering investing in property only to hear you should stick with stocks? Maybe it…

How does inflation affect property prices?

Savvy property investors have a lot to keep their eye on: interest rates, wages growth, unemployment, market rents, market movements…

“Commercial property investment an SMSF winner” | By Cal Doggett – Published in The West Australian

Make no mistake, self-managed super funds come with a price tag. Financial planners aren’t shy to charge up to $5000…

Labor’s “Help to Buy” scheme won’t solve housing affordability issues – here’s what will

There’s a tendency to hold one’s breath when hearing of a new government’s policies, particularly in the real estate sector.…

How to avoid buying contaminated commercial property

We’ve said it a thousand times on this blog… Due diligence is key to successful commercial property investing. If you…

A mid-2022 snapshot of the industrial property market

We’re nearly halfway through 2022 (thanks to our accountant for reminding us), and as commercial real estate experts with our…

6 remarkable benefits of an illiquid investment

Illiquidity can get a bad rap. Investors typically want the flexibility of pulling their funds out of an investment seamlessly…

The burning truth about sustainability in commercial real estate

Did you know buildings are responsible for 40 per cent of the world’s carbon emissions? They even use 40 per…

Labour to become main driver of building costs in Australia

While the construction market is riddled with personnel shortages, it appears labour will overtake material costs as the main driver…

Investing in Australian property from overseas

Foreign investors have about AU$4 trillion invested in Australia’s economy, with a significant portion dedicated to Australian real estate. The…

How long should you hold a property investment?

Ask the average Australian real estate investor how long you should hold your property investment and they’ll likely tell you…

Has Australia’s office market recovered from COVID-19?

When the pandemic first hit our shores, cities became ghost towns. Buildings were hollowed out, white collar workers turned kitchens…

![Interest rates in 2022: What do Australia’s banks predict? [Updated July 2022]](https://staging.pandp-admin.com/wp-content/uploads/2017/08/why-banks.jpg)

Interest rates in 2022: What do Australia’s banks predict? [Updated July 2022]

21/07/22 – Author’s note: Interest rates rose by 0.25 per cent in May 2022, 0.50 per cent in June 2022,…

Why build a reserve fund for your commercial property investment?

If you’ve partnered with a commercial property investor before, you may have seen the section of the Information Memorandum (IM)…

![Australian property market outlook for 2022 [CBRE Report]](https://staging.pandp-admin.com/wp-content/uploads/2022/03/grant-lemons-jTCLppdwSEc-unsplash-1.jpg)

Australian property market outlook for 2022 [CBRE Report]

According to their latest report, global real estate giant CBRE are tipping another excellent year for Australian real estate markets.…

Will Perth’s development delay boost property values?

Perth was looking forward to a pipeline of stunning and highly priced apartment developments totaling $2.2 billion, the impact of…

How change creates value in commercial real estate

Us passive property investors, who seek consistent income from a rock-solid tenant, prefer security over risk. We’d take guarantees over…

What will the extended border closure mean for WA’s property market?

This week was set to be the first time in nearly two years WA’s hard border came down. February 5…

Investing in debt? Here’s why private debt funds are booming

Debt is often made the villain of personal finances. Hearing ‘Get out of debt quickly,’ ‘Dig your way out of…

What does 2022 hold for Australian property investors?

Australian property investors will continue to find prosperity in 2022. It’s a proud time for the real estate industry, which…

Australian retail performance in 2021, and our thoughts on 2022

A new report released by FTI Consulting has let us in on the biggest achievements and challenges of Australia’s retail…

New JLL report hails WA an industrial winner

A new report from JLL is hailing West Australia as an economic powerhouse in 2021. And not only is the…

Can Australia’s government improve housing supply and affordability?

The Property Council of Australia (PCA) is outlining a proposal to the federal government for a housing supply deal in…

What to do if residential property is out of your budget?

For many overwhelmed property investors, residential prices across the country have become notoriously high. Even those who’ve been in the…

Why manufacturing in WA makes a whole lot of sense

Listen up industrial landlords. If the pandemic hasn’t done enough to drive industrial property values through the steel roof, with…

3 ways to achieve capital growth in commercial property

Many new commercial property investors forget that there is significant capital appreciation on offer during the lifetime of their investment.…

What does Annualised Return mean in commercial real estate?

There are many types of ‘return’ you may hear when coming across your first (or even second or third commercial…

7 tips for a successful commercial property due diligence

A thorough commercial property due diligence might be the difference between a successful long-term investment and a failed commercial real…

Why commercial solar is a bright idea for landlords

While businesses are hard at work from nine to five, the sun is too. This makes commercial solar power systems…

5 reasons office space will remain relevant well after COVID-19

Australian property group Investa issued a report in June 2021 based on the findings of a survey of over 350…

What Capital Gains Tax means for commercial property

Chances are, if you’ve sold a commercial property, the disposal will be subject to capital gains tax. CGT on commercial…

Case Study: How we safely doubled our investor’s money (in 2 years)

Introducing 50 Arc Place, Larapinta QLD In February 2019, 38 investors placed their funds with us to purchase a commercial…

How much money do investors lose every year?

You never hear about the losses – only the gains. That’s what my dad used to tell me when we…

Benefits of buying commercial property with existing tenants

Ask any commercial property investor what the most important aspect of a commercial property investment is, and they’ll most likely…

The rise of cold storage investment and how you can invest

Trends come and go, but some invariably stick around for the long run. The latest trend here to stay in…

How ASIC and the ATO regulate SMSF borrowing

Treasurer Josh Frydenberg has said the government doesn’t plan to make changes to Limited Recourse Borrowing Arrangements (LRBAs) – where…

A due diligence checklist for buying commercial property

Commercial real estate is renowned for its complexity. Beyond the jargon and sophisticated process to own and hold a commercial…

Perth property boom makes WA an investor’s gold mine in 2021

The nightmare that Perth’s residential market was meant to have during COVID-19 never quite came. Instead, Perth property sales hit…

How to calculate capital growth for your property investment?

Calculating capital growth on a property is a must when assessing your investment options. Commercial real estate investment is a…

Melbourne industrial market continues its strength into 2021

Make no mistake, the Melbourne industrial property market in 2021 is hot property. In the first two weeks of the…

Australian commercial property markets: Review of 2020

Back in March 2020, none of us would’ve expected that the year ahead would be the most unprecedented of our…

What makes the best countercyclical investment?

A chunk of the properties we research are countercyclical investments. Countercyclical investments have proven their worth for us, time and…

This is a test post

This is a test post where will do our gravity forms embed testing. Testing on demand updates [gravityformnextjs id=”44″ title=”true”…

The future of physical office space in Brisbane CBD

Since COVID-19 introduced flexible work arrangements to many business in Australia, the future of the physical office space has…

AFR Rich List taken out by property investors

Property developers and investors were the backbone of the Australian Financial Review’s 2020 Rich List. The list highlights Australia’s wealthiest…

QLD property 2021: Outlook for Brisbane commercial real estate

Brisbane’s commercial real estate market outlook for 2021 is quite positive amidst unprecedented uncertainty. The ecosystem in QLD has changed…

What is direct property investment? And should I invest?

In Australia, we sometimes use another term to describe real estate investments. That term is direct property investment. Direct property…

What makes the best logistics real estate investment?

In a recent JLL survey, more than 80 per cent of industrial property investors plan to invest in logistics real…

7 things to look for in an industrial real estate investment

Industrial real estate has become one of the most popular investments in Australia. With COVID-19 increasing the relevance of logistics…

Why buying shares during COVID-19 is a bad idea for new investors

COVID-19 turned the world of share investing upside down. And if we had a dollar for every person we’d heard…

Why the future of Large Format Retail could be industrial

Revered investor Ray Dalio says the biggest challenges can be overcome by creativity. Those who can innovate and adapt well will be…

6 tips on property investment in Melbourne

Real estate is a good investment in Australia because of its strong, stable yields, and high capital growth potential. Plus…

What is a Property Syndicate? And why invest with one?

Australians love their property. 67 per cent of Australians own their own home, and according to the ATO over two…

What we learnt from our biggest property syndicate

Pathway Twelve Unit Trust is our latest commercial property investment. It gives our investors a high-yielding, secure and long-term income…

5 reasons industrial real estate is the most resilient commercial property sector (JLL)

“The industrial & logistics sector has proven to be the most resilient of the core commercial property sectors” according to…

What is core plus real estate?

Passive investors like property investment for its consistent, stable cash flow. They might buy property with high income potential to…

Using super to buy property

This information is current as at June 2020. For updates on Self-Managed Super Fund (SMSF) information, head to the Australian…

How to find off market commercial real estate?

There’s nothing wrong with a bit of competition, but when hunting for a good property deal, the less rivals the…

6 property investment strategies after COVID-19 (part one)

12 years ago, investors faced a calamity unlike most had ever witnessed. The Global Financial Crisis came to town, slapped…

How “essential services” is the new property market driver

The commercial property investment market will look different after COVID-19. Sure, many parts of the commercial property machine will work…

How residential and commercial property investment really differ (when the economy takes a dive)

Commercial property versus residential property. It’s been a long battle. There are lovers and haters of both investment types and…

How has COVID-19 impacted property values in Australia?

Uncertainty is the flavour of the quarter as the media paints our newsfeeds with COVID-19 headlines. Doubt has also crept…

How have Australian real estate and shares performed in a financial crisis?

There’s a real benefit to real estate being an illiquid asset during a financial crisis. You can’t sell a property…

The dos and don’ts of commercial property investment during the COVID-19 period

Australians are bound by strange new guidelines. We’re at home instead of the office. We’re working from the kitchen table…

COVID-19 impact on commercial property leases

The purpose of the COVID-19 Commercial Leasing Code of Conduct, announced on Tuesday, 7 April 2020, is to provide order…

Is commercial property still a good investment in 2020?

Commercial property investors have a lot to be confused about in 2020. COVID-19 is creating more questions than answers, particularly…

Complete guide to investing with a property investment company

Property investors don’t have to go it alone. Nowadays, they have the option to invest with a property investment company,…

What is a REIT (Real Estate Investment Trust)? Does it differ from unlisted property trusts?

Looking for a set and forget commercial property investment? Two popular choices are a Real Estate Investment Trust (REIT, or…

Australia’s office market is hot property for investors (JLL)

JLL Research has taken a deep dive into Australia’s office property market with its new 2020 office market report. From…

Is investing in residential or commercial property better?

Residential and commercial property both have great benefits, particularly for those who know how to invest in them. For example,…

What is a good return on a commercial property?

Commercial property investment is popular for those who want solid cash flow. And that’s typically what commercial real estate provides:…

How much is capital gains tax on a commercial property investment?

Let’s face it, Capital Gains Tax (CGT) can put a dampener on your profits. All that hard work you’ve done,…

6 tips before selling a commercial property

The choice to sell a commercial asset shouldn’t be taken lightly. After all, commercial real estate can be a fruitful…

What commercial property investors are doing in 2021

Where were you last year? Sitting on the sidelines? Funds kept in the bank, wrapped in cotton wool? Or were…

4 best commercial property blog posts of 2019

We could talk about property all day. Fine, we do talk about property all day. Which is why publishing commercial property…

How to invest in commercial property?

Commercial property can seem like the golden ticket to some. Putting money into an appreciating asset with 6 per cent…

Want to buy commercial property? Here’s how

Buying commercial property means having a strategy. You need to understand the location – whether buying in Perth, Sydney or…

3 reasons Brisbane’s industrial property market is booming

You don’t have to look hard for good news on Brisbane’s industrial property market. Property values are headed skyward, investment…

5 ways to drive capital growth in commercial property

The beauty of providing commercial property syndicates is the surprise on investors’ faces when we tell them we’ve added 30…

Case Study: 40% gross return in 5 months: How our Larapinta investment delivered

We can get in here and reposition that tenancy profile, and extend that lease, and look that risk right in…

Which is the best commercial property investment?

Long leases, regular rental reviews and month-to-month income. These and many more reasons exist for commercial property being a stable…

Why Perth industrial property could rival the east coast

Seven years of poor Perth industrial property values could be behind WA. And values could even be set to rise…

Single tenant versus multi-tenanted commercial properties

A common debate we hear in commercial property circles is between investing in a single tenant property versus a multi…

Why car parking matters in commercial property investment

Car parking matters in commercial property because it matters to businesses. It keeps commercial tenants happy and ensures customers keep…

3 key drivers of the commercial real estate market

When behind the wheel, you need to see what’s ahead to know where you’re going. Practical, right? Well, commercial real…

Signs of recovery in Perth industrial property market

When WA’s last resources boom came to a halt after 2012, the state’s industrial property values dropped from the sky.…

Is commercial property the right investment for you?

Everyone is different. This blog post does not take into account the financial situation or capacity to invest in commercial…

Commercial property depreciation is a gift for investors

Commercial property depreciation is the ageing of commercial real estate assets and fixtures over time. The decrease in value of…

5 unique economic indicators for commercial property investors

It’s all about time in the market. That’s what some commercial property investors say about successful investing. Others protest that…

Case Study: Creating value from a vacating commercial tenant

For commercial property syndicators who are truly on the line with their investors, bumps and all, three major goals exist:…

What to include in a commercial property investment strategy

“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” Commercial…

Could the coworking trend become a property empire?

Coworking giant WeWork is now a budding property investor. Its parent, The We Company, has set up a US$2.9 billion…

Complete Guide to Commercial Property Jargon

Absorption Rate The amount of time it would take a sales agent to sell a property, applied to a percentage,…

Want to invest in residential property? Read this first

What do investors usually invest in? Well, the goal for investors is wealth creation, so they should consider many options…

How mining can impact commercial property investment

There are many drivers in commercial property investment. Economic growth, inflation, exchange rates and the official cash rate are just…

Why commercial property investments need a Reserve Fund

It might not happen in the first month, or even first year, but eventually a time comes when your commercial…

How retirees can replace franking credits income

“I will lose a quarter of my income and other people will lose about a third of their income.” Self-funded…

Best Performing Supers lose to SMSF commercial property investment

When the country’s best performing super funds were listed in the AFR’s Smart Investor on Saturday, 2 Feb 2019 –…

Why investors are choosing property over shares

People pick sides. Some rave about their Mercedes C300 while others stand by an Audi A4. Some golfers say tournaments…

How experiential retail is fighting the eCommerce threat

If you’ve visited certain Bunnings Warehouses recently, you might have stopped to have a coffee at their in-store café. Or…

Case Study: The perfect introduction to commercial property investing

Opportunity Alan Doggett, co-founder of Properties & Pathways, has had global success in commercial real estate. This was well known…

5 rules for successful office investment (in any market)

“Risk comes from not knowing what you are doing”. Warren Buffett’s advice rings true for investors who don’t have the…

Investment in commercial property still popular, safe and smart

If you’re an experienced property investor, you might already know this. Maybe you’ve reaped the tax rewards or had an…

Commercial property in Australia just became a safer investment

Whether the news is pretty or ugly, a good property investor will keep a finger to the air for industry…

eCommerce makes hot property of industrial real estate

Click and you shall receive. Whether or not you’re an online shopper, eCommerce is making waves in Australia. The promise…

5 ways experts research the commercial property market

Scanning real estate listings and hoping an investment gem will fall in your lap is like taking an exam without…

PropTech and the real estate technology revolution

You might not think the digital age would transform how we buy and sell real estate. After all, property is…

How to access a Limited Recourse Borrowing Arrangement (LRBA)

This information is current as at August 2018. For updates on Self-Managed Super Fund (SMSF) information and borrowing under a…

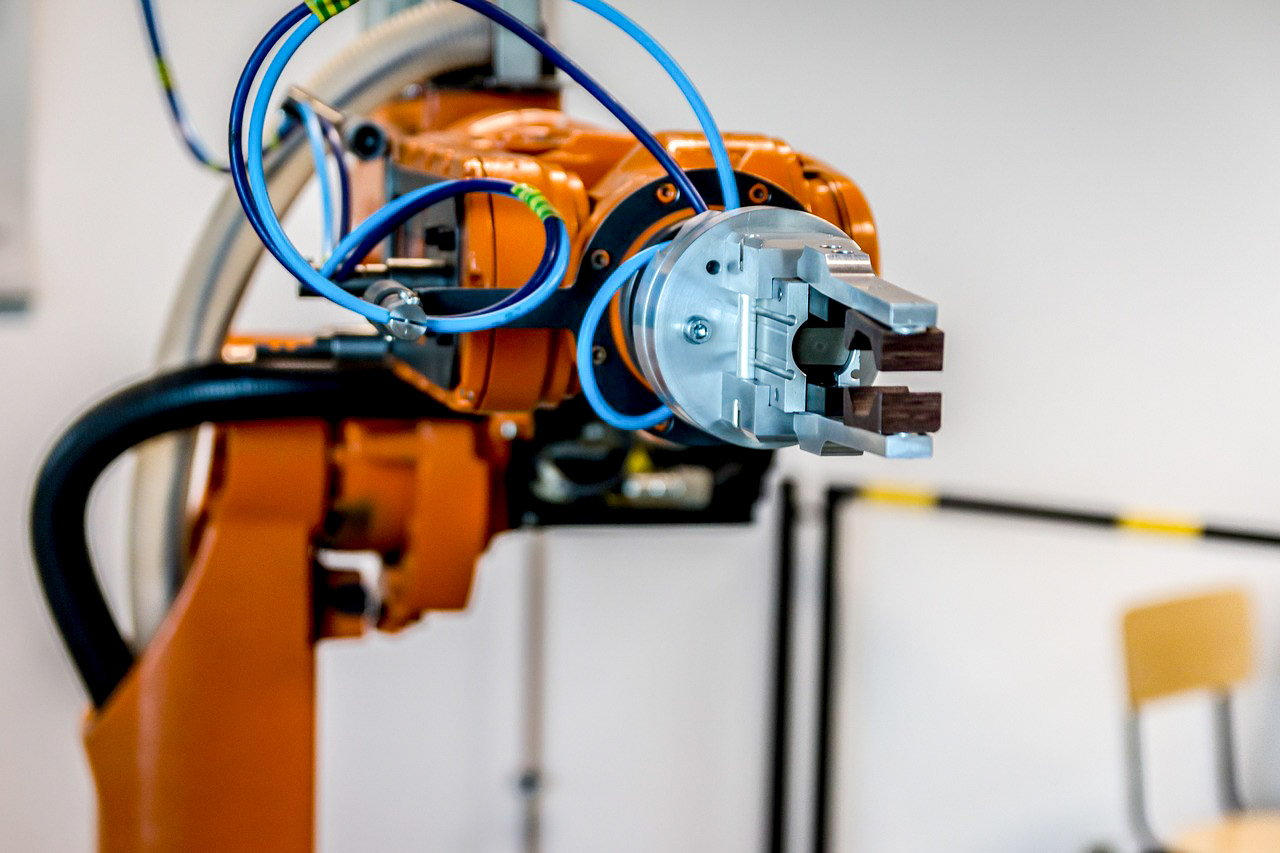

How automation is transforming industrial property

We talk of battery-operated cars flooding our roads and read about their impact on oil company and government profits. News…

5 questions to ask before you invest in commercial property

Investing in a commercial property can require making very different considerations to investing in residential property. When putting your money…

Why end of trip facilities are essential to office properties

These days, many active office employees are attracted to workplaces enabling them to commute in an active manner and then…

How residential and commercial property loans differ (Part Two)

Who Is the Tenant? Residential Loans A tenant of a residential investment property will usually need to have just one proven…

How residential and commercial property loans differ (Part One)

In part one of this post, we run through a few of the fundamental differences between residential and commercial property…

Commercial Property: Where to invest in Australia

We can always find advice on what Australian cities are home to the best commercial property investments. For instance, some…

Flexibility: The driver of coworking office space demand

Existing landlords of traditional office real estate need to be aware and prepared of the demand for new flexible working…

Beware of the serious downsides to ‘development upside’

Development upside refers to a property’s potential for redevelopment – anything from adding an extra storey, extending the floor space…

What makes the perfect office property acquisition (Part Two)

In last week’s post, we dissected the noticeable characteristics of the perfect office property acquisition: Sufficient car parking Sustainability End-of-trip…

What makes the perfect office property acquisition (Part One)

No two commercial property investments are alike. Even two properties in the same category – office, retail or industrial, for…

5 ways commercial property and residential property investment differ

When thinking about how commercial property and residential property investment differ, most investors believe residential property is the much more…

Kathmandu proves retail growth opportunities still exist

The AU$97 million (US$75 million) acquisition of the hiking boots business comes after Kathmandu announced a 23 percent increase in…

What makes the perfect industrial property investment?

Commercial property investment is often thought of as retail space, shopping centres, or office towers in the CBD. Due to…

Why it pays to invest with a commercial property investor

New investors are flooding into the commercial property space. It’s not hard to see why. Stocks and bonds aren’t yielding…

Case study: 40% return in 18 months: Our Tuggerah success story

The final sale price was $10,800,000. That’s $3,260,000 more than we paid for it in June 2016 — but the…

6 advantages of investing through a property syndicate

Investing with a property syndicate or unlisted property trust is a safe and secure way to profit from commercial property…

Why commercial property may be a better investment than shares

In deciding which one, the logic normally goes something like this: Residential Property It’s a physical asset that will hopefully…